Modern approach.

Personal touch.

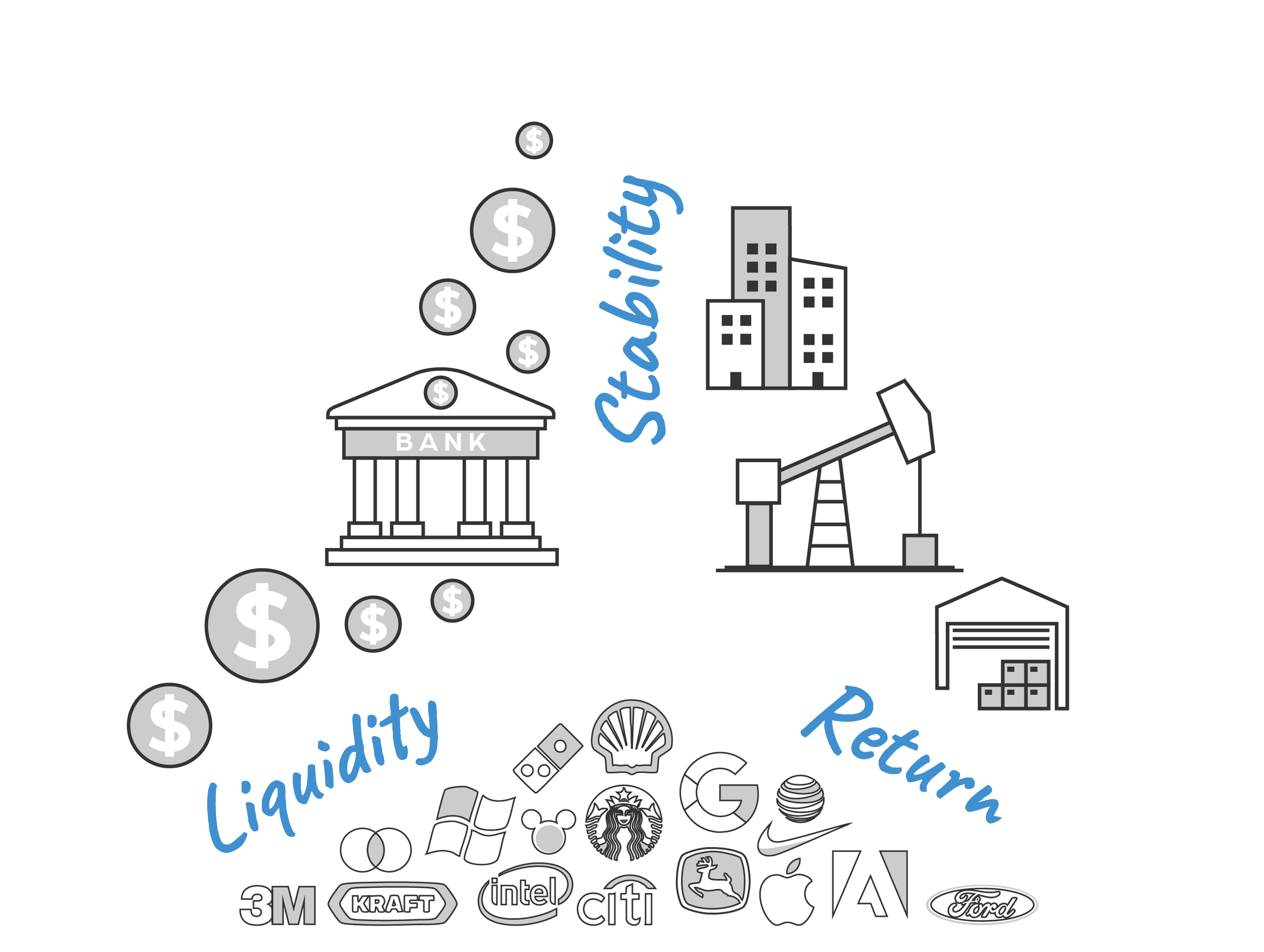

The principal drivers of investment decisions.

-

This path involves the mitigation of a portfolio's overall volatility which can be accomplished by including traditional bank offered investments and/or non-correlated alternatives such as Private Equity Real Estate and Private Credit. Too much of one may lead to a sacrifice in the portfolio's overall return whereas too much of the other may result in insufficient liquidity. Prudent allocation promotes a balanced outcome.

-

This path leads to rewards—capital gains, dividends, and growth. Some paths have shortcuts (quick profits), while others require patience and perseverance for long-term wealth building.

-

Liquidity determines how quickly and easily you can access your money. Some investments, like stocks, provide fast exits, while others, like real estate, require more time to convert into cash. Choosing this road carefully ensures you have financial flexibility when needed.

Let’s clear the fog from your financial horizon.

-

The types of investments in a portfolio—like stocks, bonds, or real estate—have the biggest impact on how it performs over time. Our job is to make sure each client’s mix of investments matches their goals and comfort with risk.

-

While individual security selection contributes to investment outcomes, overall returns are primarily influenced by strategic asset allocation. Each asset class serves a distinct function, and a well-balanced portfolio ensures they work in concert to achieve the desired financial objective.

-

Strategy plays a big role in how your investments perform over time. Whether you’re aiming for growth, income, or a mix of both, we start by making sure that we understand your present needs and goals. As life evolves, we'll refine our recommendations to keep your portfolio aligned and up to date.

Our Strategy

Brokerage. Advisory. Clarity.

Trivium Asset Management Partners operates across both RIA and Broker-Dealer platforms, giving us the flexibility to deliver institutional-caliber solutions—such as access to alternative investments and advanced tax mitigation strategies—while maintaining the personalized guidance high-net-worth individuals and institutions expect. This structure allows us to act in our clients’ best interests without being limited by a single advisory framework.

We offer a hybrid full-service Independent Broker Dealer and Registered Investment Advisor platform to our clients.

The Institutional Advantage

Data sourced from the 2024 NACUBO-Commonfund Study of Endowments

Why the Average Individual Investor Falls Behind—And How Trivium Helps You Get Ahead

Average individual investors tend to react emotionally to market swings, often buying high and selling low, which erodes returns over time.

At Trivium, we bridge the gap between institutional discipline and individual investor experience by delivering both traditional and alternative investment strategies—designed not only to enhance long-term performance, but to help clients stay the course through emotional market cycles.

The average individual investor has historically underperformed the market, with 20-year annualized returns closer to 2%–3%, according to studies like those from Dalbar Inc., which track investor behavior and fund flows. This gap is often attributed to differences in behavior and strategy.

Endowments (Institutions) typically follow disciplined, long-term investment strategies with ultra diversified portfolios, including non-correlated alternatives like private equity and private credit.

Investment Solutions

At Trivium, our guiding principles are centered in the fiduciary standard and Regulation Best Interest (Reg BI).

Our team.

The Trivium team brings over 50 years of combined experience in banking and financial advisory.

Our founders have served in leadership capacities within the largest financial institutions as well as regional and community banks, giving us a deep understanding of what each does well - and where they fall short. Big firms offer advanced technology and broad investment options but often miss the personal touch. Community banks excel in client relationships but may lack modern tools and solutions.

At Trivium, we combine the best of both: institutional-quality investment solutions and cutting-edge technology, delivered with the warmth and personal attention you’d expect from a community-focused firm. We serve key regions including the Rio Grande Valley, Houston, Central Texas, Dallas/Fort Worth, and beyond.

Your goals deserve more than good intentions.

They deserve our highest standard.

At Trivium, we don’t just follow the rules—we lead with integrity. Guided by the fiduciary standard and Reg BI, we’re committed to doing what’s right for you, every step of the way.

Let’s start a conversation about your future.